The Nigerian Consumer Credit Corporation (CREDICORP) has officially launched its nationwide Cultural Reorientation Campaign with a landmark market activation held at the Sani Abacha Stadium in Kano.

CREDICORP, a key initiative under President Bola Ahmed Tinubu’s Renewed Hope Agenda, is committed to democratizing access to consumer credit for hardworking Nigerians.

Minister Woos French Investors with Nigeria’s Economic Reforms

By enabling citizens to purchase essential goods and services—such as locally assembled vehicles, solar energy solutions, and home improvement products—on credit, the Corporation is reshaping how Nigerians engage with personal finance.

This campaign marks the rollout of the third pillar of CREDICORP’s national strategy—Cultural Reorientation, which complements its other pillars: Infrastructure and Capital.

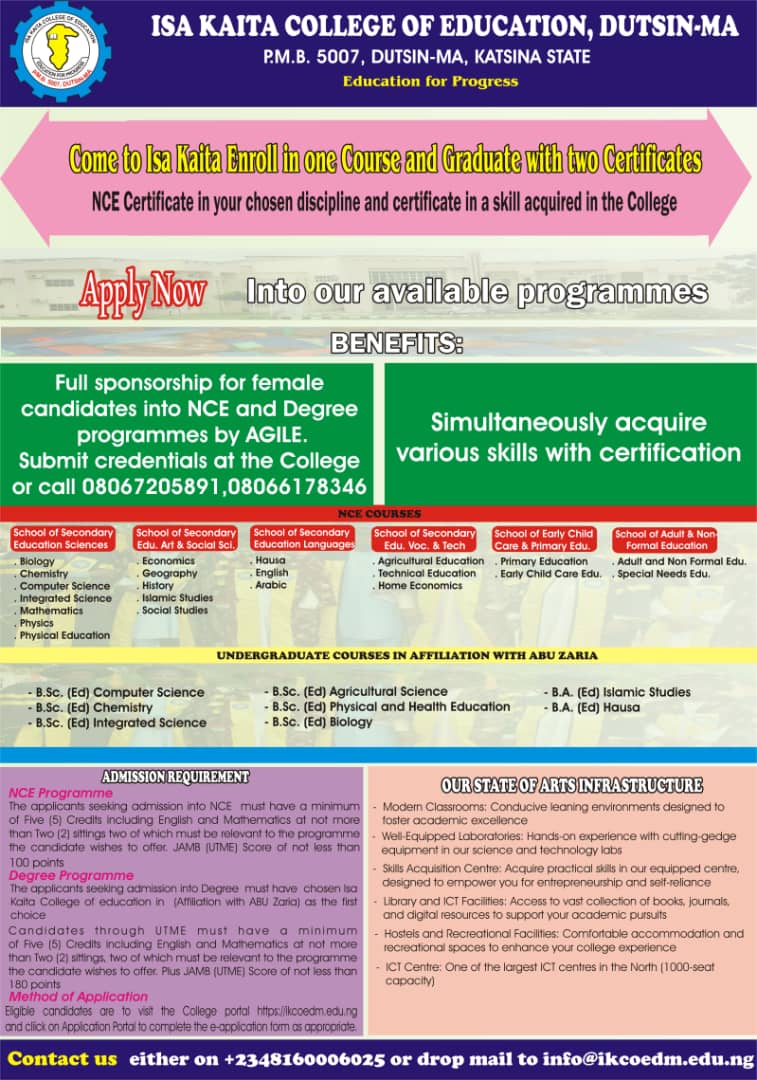

Federal Government Unveils Bold Education Reforms

The goal is to shift public perception of credit from being seen as a financial trap to being embraced as a tool for personal and economic growth.

In the past year, CREDICORP has introduced several impactful programmes under its mandate, including:

Project S.C.A.L.E (Securing Consumer Access for Local Enterprises) – promoting local industries by channeling consumer credit toward Nigerian-made goods and services.

The C.A.L.M. Fund (Credit Access for Light and Mobility) – providing affordable credit for CNG vehicle conversions and solar home systems.

YouthCred – extending responsible, affordable credit to 100,000 National Youth Service Corps (NYSC) members at the start of their economic lives.

The Kano activation event brought together government officials, financial institutions, and trade leaders. His Excellency, Governor Abba Kabir Yusuf of Kano State, led the event, accompanied by representatives of the state government, market associations, trade cooperatives, and Participating Financial Institutions.

Participants were sensitized on key financial literacy topics, including:

How consumer credit works, with both interest-based and non-interest financing options;

The importance of responsible credit use versus harmful debt;

The benefits of building a verifiable credit history;

CREDICORP’s partnerships with traditional and non-interest financial institutions to offer inclusive credit solutions.

The event featured live testimonials from credit beneficiaries and included pre- and post-activation surveys to measure changes in public understanding and sentiment toward credit.

This first activation in Kano marks the beginning of a nationwide campaign to promote consumer credit as a means to economic empowerment and an improved quality of life.

Similar activations are planned in other states in the coming months