Auwalu Musa Yola

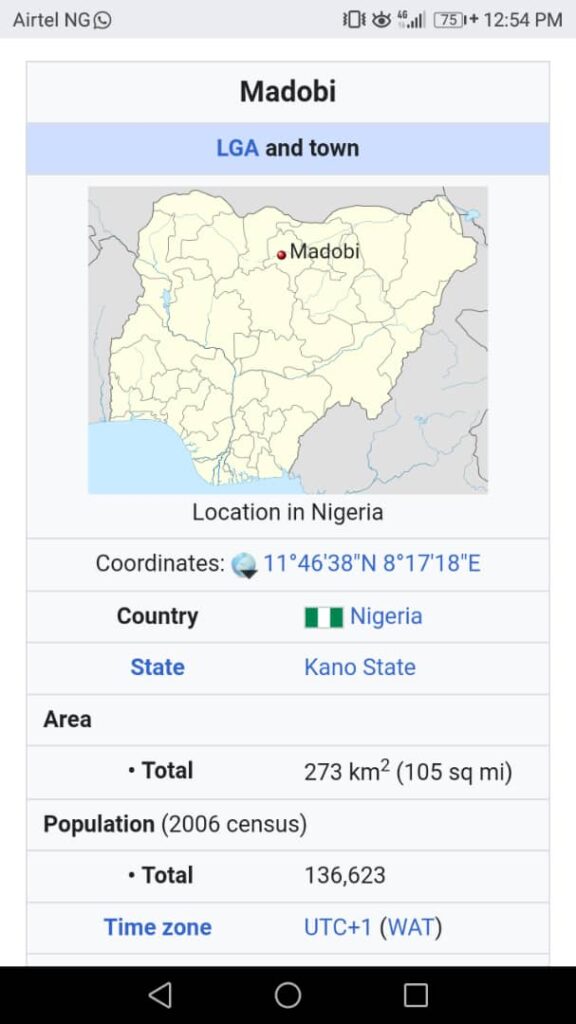

Tucked away in the heart of Kano State, Nigeria, lies the ancient city of Madobi, a thriving community with a rich history and culture.

However, despite its significance, Madobi Local Government area remains an anomaly in the modern financial landscape.

The city lacks a single commercial bank, making it one of the few cities in Kano State without access to formal banking services.

This glaring absence of banking services has far-reaching implications for the residents of Madobi, affecting every aspect of their lives.

From commerce and trade to education and healthcare, the lack of access to formal banking services has led to a reliance on informal financial systems.

Thrift collectors and money lenders, who often charge exorbitant interest rates, have become the norm.

The challenges facing the community are multifaceted. Without commercial banks, residents of Madobi struggle to access credit facilities, making it difficult for them to start or expand businesses, or even meet basic financial needs.

The absence of banking services forces the community to rely heavily on cash transactions, making them vulnerable to theft, robbery, and other financial crimes.

Furthermore, the lack of electronic payment systems hinders the smooth operation of businesses, leading to delays and inefficiencies in transactions.

The unbanked status of Madobi excludes its residents from participating in the formal financial system, denying them access to essential financial services and opportunities.

Madobi Council Chairman Distributes Sports Kits to Football Clubs

To address this pressing issue, there is a need for urgent intervention. Financial institutions, such as UBA, First Bank, Fidelity Bank, Jaiz Bank, and GT Bank, are urged to consider establishing branches in Madobi, providing much-needed financial services to the community.

Relevant government agencies should also support initiatives that promote financial inclusion and provide resources to facilitate the establishment of banking services in Madobi.

Additionally, community leaders and the Local Government Council Chairman are called upon to provide the unused Madobi Micro Finance Bank to one of these commercial banks.

Madobi LG Holds Town Hall Meeting on 2025 Budget

By doing so, the community can bridge the financial gap and unlock its full potential.

By providing access to formal banking services, Madobi can improve the lives of its residents, promote economic growth, and reduce poverty.

It is imperative that stakeholders take immediate action to address this issue and provide the community with the financial services they deserve