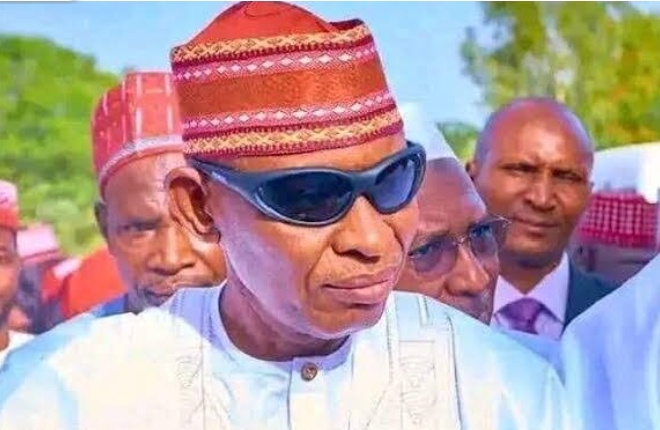

The Kano State Government, led by Governor Abba Kabir Yusuf, is set to begin prosecuting tax defaulters in 2025 as part of comprehensive reforms in tax administration.

This initiative is aimed at enhancing revenue collection and ensuring compliance with tax laws to boost the state’s economic development.

Kano Lawmakers Reject Controversial Tax Reform Bill

According to Sanusi Bature Dawakin Tofa, the Director General of Media and Publicity at Government House, Kano, the reform was disclosed during a presentation by Dr. Zaid Abubakar, the Executive Chairman of the Kano State Internal Revenue Service (KIRS), at a High-Level Retreat for senior government officials.

Dr. Abubakar emphasized that the reforms would not impose new taxes but would focus on improving the efficiency of the existing system.

Tinubu Recieves NEC’s Recommendations On Tax Reform Bills

The state has projected generating over ₦20 billion quarterly, totaling more than ₦80 billion in 2025, by adopting innovative approaches to tax collection.

Governor Yusuf’s earlier decision to restructure the revenue agency by appointing a new management team in 2024 has already resulted in improved performance in the latter half of the year.

The administration plans to introduce a new tax collection model in 2025 to further enhance compliance and transparency.

This significant revenue boost will enable the government to implement critical developmental programs across various sectors, fulfilling its campaign promises to the people of Kano State.